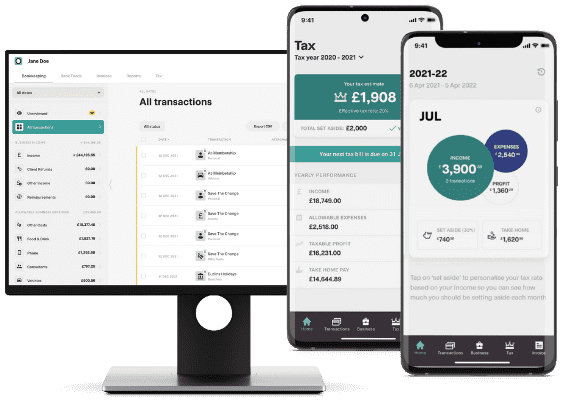

Read my updated coconut accounting review! Coconut has changed so much since it launched – from a bank account / banking app to accounting for sole traders. Check out my tips on how to manage your freelance finances using Coconut accounting.

It was way back in 2018 when I first discovered Coconut – a banking, accounting and tax app when it first started. However, over the years, they evolved, removed current accounts and became solely Coconut accounting.

Having been a freelancer for well over a decade now, I’d like to think I’ve gotten to grips with my finances pretty well over that time, including freelancer tax and expenses.

One of the main reasons I had started using Coconut was to keep my business finances separate to my personal finances, making it easier to manage money and for the annual self assessment.

What Is Coconut Accounting?

I couldn’t say it better than Coconut do themselves. Coconut is a simple tax app for self-employed people and accountants.

So that includes bloggers, influencers, small business owners, fitness professionals… basically anything that isn’t covered by PAYE (when the tax man dips his hand in before the money reaches your account).

Quarterly Tax Returns Are Coming

It’s worth noting that back in 2015, UK government announced Making Tax Digital (MTD), an initiative to end the annual tax return and reform the entire tax system. MTD was due to come into effect in 2024. Self-employed individuals will be required to complete four tax submissions a year instead of one, using a digital product—like Coconut.

❌ Making Tax Digital for Income Tax delay

However, in December 2022, HMRC announced that it will be delaying the introduction of MTD until April 2026, and that it will also be changing the income thresholds—meaning that certain taxpayers will no longer have to meet the requirements (for now). You can read more about the delay here on Coconut.

That means there is no time like the present to get used to managing your finances digitally.

Coconut Accounting App Pricing

Since Coconut closed all their current accounts, they also changed their pricing model. Currently (January 2023) there is no free version of the app however you can get one month free using my referral code – I will also get one month free.

After that, the app costs £7.50 per month.

Using Coconut Accounting App

Below, I’ve tried to cover the main areas that you and I would need as freelancers; the things that will make our admin less and lives easier… it is possible…

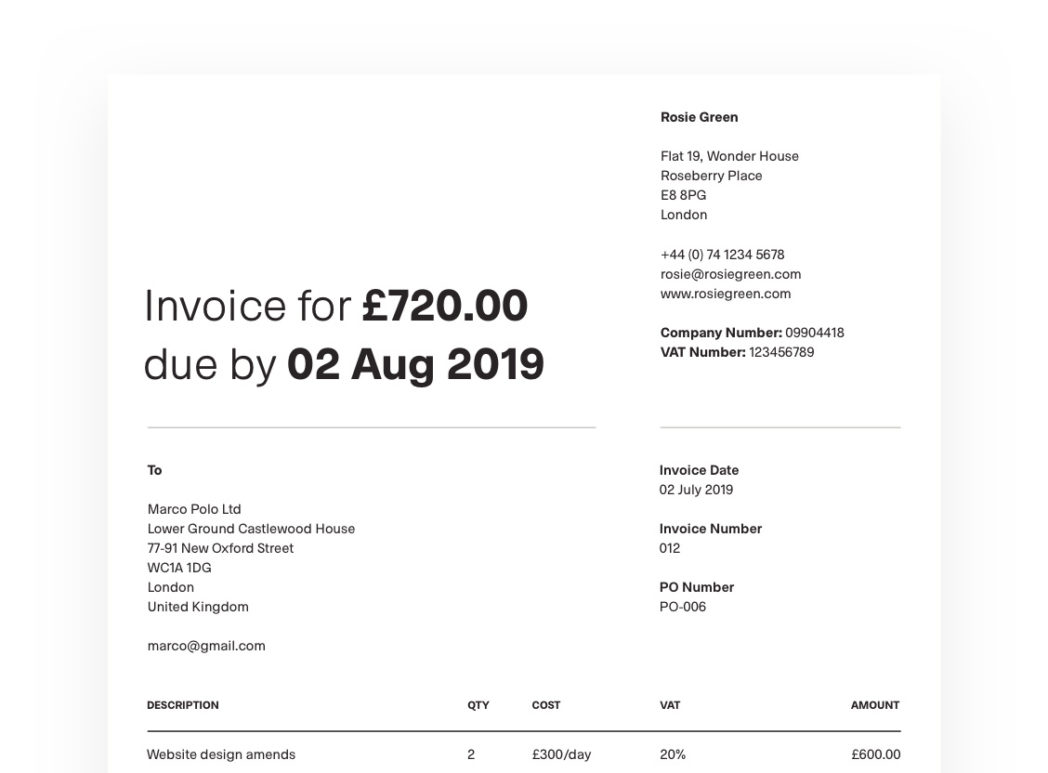

“How do I create invoices?”

This function was a game changer for me. Previously I was spending ages creating word documents and converting them into PDFs or using PayPal to create and store (not always send) my invoices. It meant invoices were all over the place whereas now, they are all stored on the app and easily downloadable if I need copies.

You can email invoices straight to your client from the app and send a copy to yourself at the same time. When you send invoices, you can also BCC in others and send a copy to yourself via email.

Invoices are unlimited and can now be branded (your logo goes in the top left corner).

“I never get paid on time”

Dammit, now isn’t this the bane of our freelance lives?! When you create an invoice in Coconut banking, you choose the due date – i.e 14 days, 30 days, 60 days or custom. Thirty days is the standard by law, remember that. Below is some text you should include in every invoice you send which will be your back up if payment is late.

You Should Include This Text On All Invoices:

“Payment is expected within a maximum of 30 days. Late payments will be charged interest at the Bank of England base rate plus 8% in addition to reasonable debt recovery costs (£40) if deemed necessary.”

You can then track invoices in the app to see when they are due or if they are overdue. One recent update means you can send an invoice again and edit the email to remind them you are due payment and politely ask that they pay swiftly so you don’t need to change the invoice and add the late fees.

If you do end up wanting to add on late payment fees and interest, you can use this site to calculate how much interest you can apply to your invoice.

“How can I keep track of expenses?”

When you’re self employed you get to claim expenses against your income which means that income (well, expenditure) isn’t counted when it comes to calculating how much tax you owe.

Things like travel, equipment, professional fees all count – and Coconut helps you to know what can and can’t be counted. I wrote a guide chatting all things tax for fitness professionals which you can check out too.

“Where can I store receipts?”

In the app you can take pictures or attach files as receipts so they will all be in one place if or when you need them. Now that Coconut can be accessed via desktop, as well as the app, it’s super easy to do all your bookkeeping.

I get alot of receipts via email so I keep a folder on my desktop for recipes which need uploading to Coconut. Once uploaded and assigned to the relevant transaction, I delete it.

Connecting Coconut Accounting To Your Bank

…or to other credit cards. This is a very useful feature made possible by Open Banking. Since I moved by business bank account to Monzo, it was super easy to connect to Coconut, where I do 99% of my banking and bookkeeping tasks.

You can now connect over 25 different types of bank accounts or credit cards to your Coconut account.

“How do I know which expenses are allowable?”

It tells you in the app. The app automatically categorises most of your spending but you can change the categorisation if needs be. When you go to change it there is an icon you can click on which tells you more about that expense category and whether it is allowable as an expense.

“I want something that makes my tax return simple”

I started using Coconut half way through a tax year so it made half of my tax return simple. For the rest of that year though, I had to do my usual trawl through spreadsheets and double checking of my personal current account and credit card.

My first full year using Coconut was 2019-20 and everything was perfectly in one place. The app also gives you an estimation of your tax bill at the end of the year based on what you have earned so far.

You’re able to edit your tax code if you need to, check a box if you have a Student Loan to repay, and add how much PAYE earnings you have received elsewhere.

You then click one simple button to see your tax report which has all your totals for expenses etc which you input directly into your Self Assessment.

More You Can Do With Coconut Accounting:

The app has so many other nifty features that come in super handy.

- Assign income / expenses to various income streams

- See a monthly overview of income, expense and profit

- Share account access with an accountant

- Get an account for a Limited Company

You Need To Get Coconut Accounting

The app and functionality is always evolving. Each and every monthly newsletter informs me of something I needed and probably never even knew I needed. If you have any questions feel free to drop me a comment below or get in touch with Coconut directly – they are on twitter here.

How are you currently managing your finances as a freelancer?

Elle

Found this post useful?

That’s great news! You can support me by leaving a comment, sharing with your colleagues, giving me a shout out or buying a me coffee…

![🍊+ 🍋🟩 = WILD 💫it’s time for a new armpit scent and I’ve gone for pink grapefruit and lime… kinda sounds and smells like a cocktail 🍹if you’ve been thinking about making the switch when it comes to deodorant, shampoo, body wash or even (the currently sold out 🥲) lip balm, now is the time 😝[aff 🔗] I gots 20% off for ya with the code ELLE2024💥 or comment WILD below and I’ll send ya the link 📨🏷️: #natural #lowtox #morningroutine #skincareroutine #personalcare #keepitsimpElle](https://www.keepitsimpelle.com/wp-content/plugins/instagram-feed/img/placeholder.png)

Hii Elle , your article gives a head start on managing freelancer finances. Its always good to see an App that takes away the hassle of managing critical things like finance that ensures cash flow. So here is a new way of doing Business Banking in UK . This is a fintech breakthrough that is not only good in managing Finance but also helps doing a lot of other stuff too. The platform is called Naxetra. It does everything that other platforms do yet goes beyond the limitations of others to incorporate AI to enhance the usability and effectiveness of Managing Finances. Its for freelancers, SMB, Contractors. And to start using it you don’t have to purchase anything . you can use it for free for doing basic stuff as long as you want.

What about the company’s that do invoices themselves or just pay you from the register you sign on?

And when will the app progress to adding own logo?

Thanks

What about them? You just get paid into your Coconut account and it is recorded as income / revenue. That’s what happens with me and the gyms I work at. Invoicing is there if you need it. You get 3 free invoices a month I believe so if you don’t need to use more, you won’t ever need to pay to use Coconut. Win, win?!

You’ll have to ask Coconut themselves about add a logo. I have asked and they have noted the request so the more people that ask, the quicker it will get to the top of their to do list.

Yes, loving the Coconut app. So many useful features for Freelancers and the self employed. I REALLY wish you could add your company logo to invoices though. I have used many invoice generators in the past and they all had the ability to add your logo, so it’s very surprising Coconut doesn’t have this.

I’m with you there! I used to just used PayPal to create invoices and they had the facility to add a logo. Coconut have been evolving quickly so hopefully they have this feature on their road map!

This app looks like a total game changer for freelancers! I love that it can create invoices for you and store them etc – everything’s all in one place and easy to find if you need to go back to it etc. So handy. xx

El // welshwanderer.com

Certainly has been a gamechanger for me! Thanks for stopping by El 🙂 x

This looks so simple! I’ll have to have a look at it, I’ve been doing my invoices the old fashioned way ?

Let me know if you sign up! Are you UK based? They are planning on launching in the US soo too if you’re over there! …and yes, it is so stress free it’s ridiculous lol

These are really good tips!

Thanks Christine!